RESORT REPORT

2022 YEAR IN REVIEW

After record-breaking sales transaction volume in 2021 and 2022, demand remains strong for real estate in resort communities throughout the Western United States. Over the past two years, many homebuyers relocated from cities to less populated regions in the Mountain West, due to the shift to virtual workplaces and demand for the mountain lifestyle.

Home prices have continued to climb as buyers demand properties in desirable locales with access to ski resorts, open space, rivers, and lakes. The average sold price for homes rose by 13.9% across the seventeen resort communities profiled in this report over the past year. The price per square foot increased by an average of 16.5%, as buyers search for properties near wilderness and outdoor recreation with limited inventory available. Year-over-year transaction volume has begun to stabilize from the buying frenzy these resort regions experienced over the past two years.

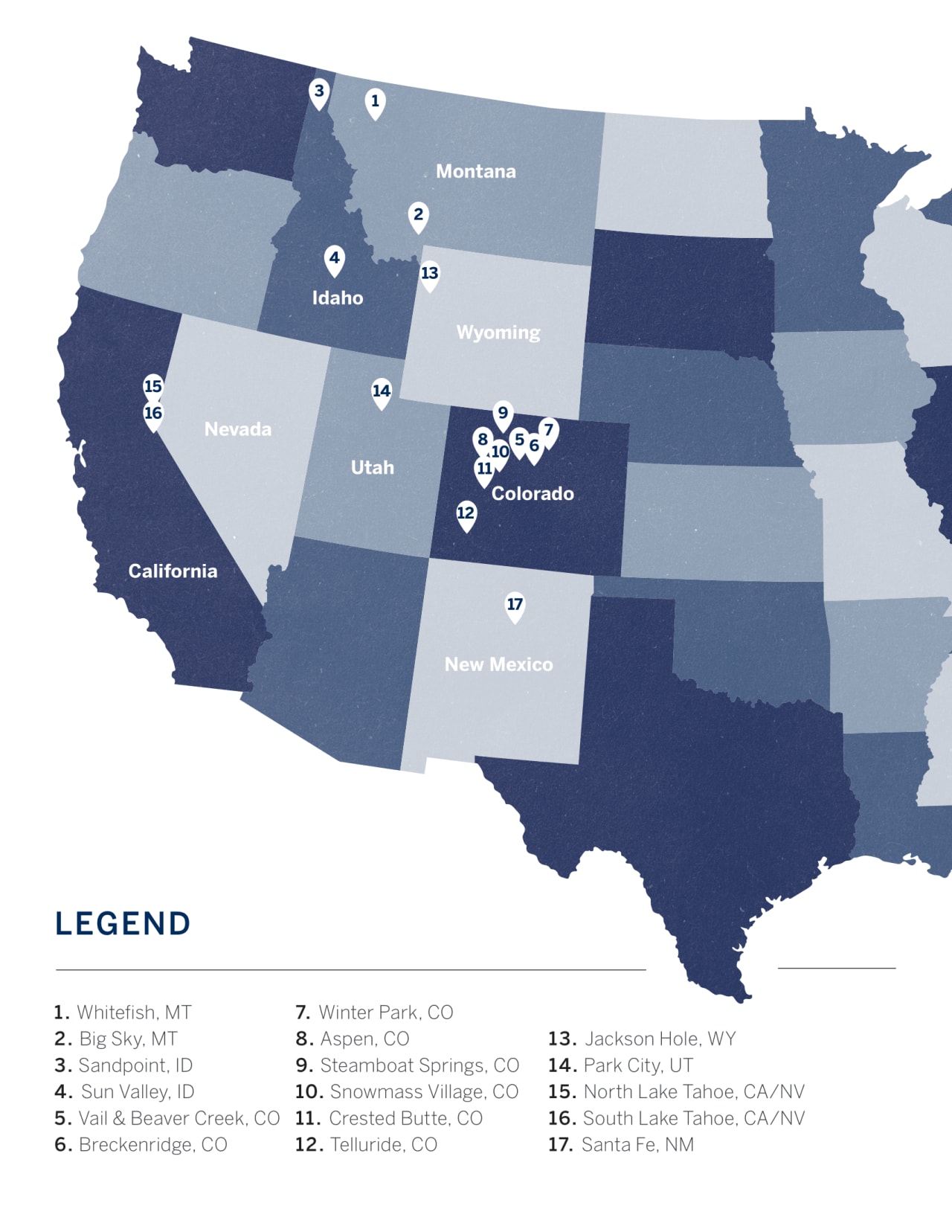

To provide analysis on these specific markets, Glacier Sotheby's International Realty, in collaboration with LIV Sotheby's International Realty and our other resort market affiliates, publishes an annual Resort Report for communities including Aspen, Beaver Creek, Breckenridge, Crested Butte, Snowmass Village, Steamboat Springs, Telluride, Vail, and Winter Park in Colorado: Park City, Utah: Sandpoint and Sun Valley, Idaho: Jackson Hole, Wyoming Big Sky and Whitefish, Montana; North and South Lake Tahoe, California/ Nevada; and Santa Fe, New Mexico.